The battle for user loyalty has always been one of the hardest-fought arenas in the world of digital asset exchanges. Traders, by nature, are opportunistic. They move quickly to platforms offering tighter spreads, lower fees, or aggressive promotional campaigns. That mobility has made it difficult for exchanges to build lasting communities or predictable liquidity flows. Most attempts to lock in loyalty, such as deposit bonuses, fee holidays, or referral schemes, have a short half-life.

The capital is quickly absorbed, user attention drifts elsewhere, and the cycle begins again.

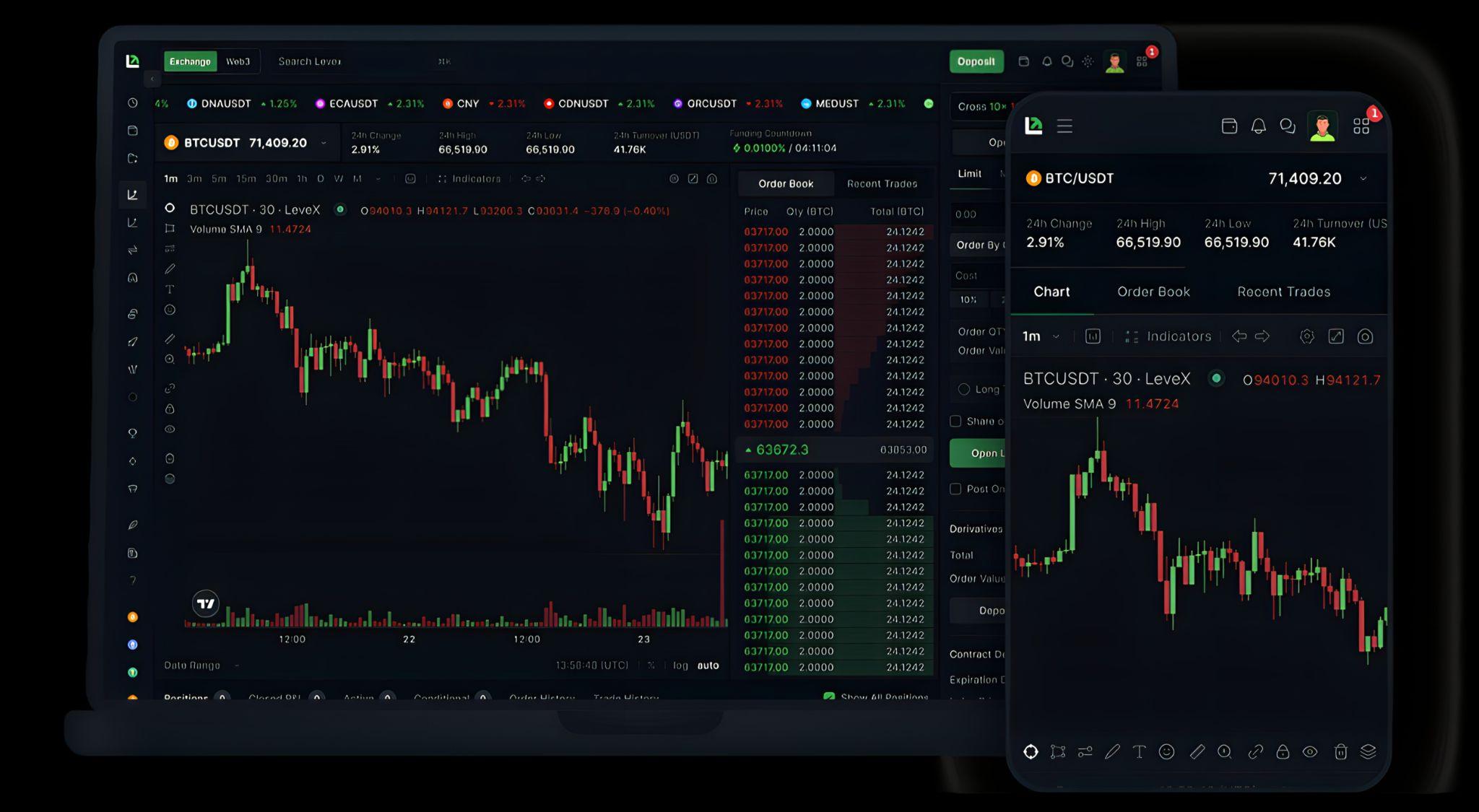

LeveX, a crypto exchange built by traders themselves, is attempting to break that cycle with a new approach. Its recently launched Quest system takes the familiar concept of gamification but reframes it through the lens of capital efficiency and trader alignment. The idea is deceptively simple: rather than offering static perks or upfront bonuses, LeveX distributes rewards progressively as traders execute their strategies. Each trade not only contributes to performance in the market but also unlocks incremental incentives in the form of usable trading capital.

Surprise Drops are randomized rewards that unlock as traders hit activity milestones on LeveX. Think sustained volume, completed quests, or streak-based participation. The structure is tiered: as traders move up through higher bands, rewards scale from meaningful fee credits to substantial Futures Credit for the most active participants. Top-tier drops can reach five figures for a small cohort of power users, aligning incentives with real trading momentum.

The randomization adds anticipation while reflecting the uncertainty of markets. Traders who thrive in volatility often find that the Quests framework matches their professional instincts: execute consistently, manage risk in real time, and be positioned to capture asymmetric upside when it appears.

This is where LeveX’s innovation diverges sharply from the rest of the field. Futures Credit is not a vanity token or a marketing placeholder. It is actual trading capital. It reduces fees, cushions losses, and can be deployed immediately to scale positions. For professional traders and institutional participants, that distinction matters. It means that rewards are not an external distraction from trading but a direct extension of it, with capital returned to the system in real time to improve risk management and cost efficiency.

The structure of Quests is also designed to complement natural trading behavior rather than distort it. A trader running an existing futures strategy will find that their volume progression automatically contributes to Quest milestones. Newer users, meanwhile, are introduced through Journey Quests, which reward basic onboarding steps like verification, deposits, and first trades. There are also Time Period Quests, which emphasize consistency over raw volume by rewarding those who maintain daily or weekly engagement.

What all of these share is a cumulative logic: progress at higher tiers includes the benefits of all lower levels, ensuring that no activity is wasted and that traders are not penalized for starting strong.

From a Wall Street perspective, Quests look less like a consumer gimmick and more like a capital allocation strategy. Traditional sign-up bonuses represent a blunt outlay of resources, capital front-loaded without clear alignment to long-term engagement. Quests, by contrast, release rewards in proportion to proven activity, distributing capital where it is most efficiently deployed.

Low-volume traders receive modest credits that lower their cost of entry, while heavy-volume participants, the ones generating the most liquidity, are rewarded with significant credits that reinforce their impact on the exchange. It is, in essence, a tiered rebate model reimagined for the crypto economy.

That strategic lens reflects the influence of Harvey Liu, the CEO of LeveX. Active in blockchain and venture capital for more than 15 years, he was an early Bitcoin participant and later a partner at a licensed Web3 investment fund. After conducting due diligence across multiple global exchanges and investing in dozens of Web3 projects, he has seen firsthand how incentive misalignment can erode trust.

In Liu’s view, too many trading venues extract more value than they return. His aim at LeveX is to reverse that dynamic by prioritizing shared knowledge over siloed decision-making. The launch of Quests extends that philosophy into incentive design, directing rewards toward deployable liquidity and practical participation rather than short-lived perks.

For traditional finance professionals, analogies can be drawn to tiered commission structures or rebate systems long used in equities and derivatives markets. Exchanges and brokerages have always designed incentives to encourage volume and liquidity provision. What LeveX has done is adapt those mechanisms to the crypto era, layering in gamified engagement without losing sight of capital efficiency.

By introducing randomized Surprise Drops, it has even managed to replicate a market-like element of risk and reward within its incentive framework.

The implications for competition among exchanges are significant. The crypto industry is crowded, and the product sets are increasingly commoditized. Margins are eroded by fee wars, while confidence remains fragile in the wake of high-profile exchange collapses. In such an environment, the ability to simultaneously deepen liquidity and build trust becomes a key differentiator.

Quests address both fronts. They sustain user activity through progressive engagement and provide rewards that are transparent, spendable, and tied to actual trading activity.

Looking ahead, LeveX has suggested that Quests will expand beyond volume and time-based formats. Collaborative challenges, team competitions, and social trading elements are all under consideration. These would bring a community layer into what is already an innovative capital allocation mechanism.

For Wall Street observers, that development is worth watching closely. It points toward a potential fusion of social finance and professional trading incentives, a combination that could reshape not just user engagement but also how liquidity pools form in digital asset markets.

Participation in Quests is deliberately straightforward. Traders must actively opt in, after which all eligible activity contributes to their progression. Dashboards update in real time, displaying current volume, next milestones, and unlocked rewards.

To keep capital in circulation, rewards follow a strict timeline: seven days to claim, three days to redeem, and seven days to deploy. That design ensures the system is self-reinforcing. Rewards are not hoarded; they are put back into the market, generating liquidity and engagement in the process.

Ultimately, LeveX’s Quests are about more than gamifying trading. They represent a carefully engineered approach to incentive design, one that balances the needs of traders with the strategic imperatives of an exchange. For the trader, the benefits are immediate: lower costs, better risk absorption, and additional capital to execute strategies. For the platform, the upside is deeper engagement, improved liquidity retention, and stronger user loyalty in a highly competitive market.

If crypto exchanges are to evolve into mature financial institutions, they will need mechanisms that go beyond superficial promotions. LeveX’s Quests may well serve as a model for that evolution, a system where capital efficiency and trader psychology are fused into a single structure. In a marketplace defined by volatility, the ability to turn the very act of trading into a journey of progressive, risk-adjusted rewards could prove to be one of the most powerful differentiators yet.

For much of its history, cryptocurrency has been locked away like gold in a vault, with holders watching market charts rise and fall while their...

For WealthTech companies, alignment is a moving target. Between evolving SEC guidance, fast product iterations, and high-stakes customer interactions, staying informed goes beyond internal efficiency....

For much of its history, cryptocurrency has been locked away like gold in a vault, with holders watching market charts rise and fall while their...

For WealthTech companies, alignment is a moving target. Between evolving SEC guidance, fast product iterations, and high-stakes customer interactions, staying informed goes beyond internal efficiency....

Phishing has become a persistent and expensive problem in financial services. Every week brings a new report of credential theft, spoofed domains, or fraudulent transfers....

The biggest change in retirement planning isn’t about the markets, inflation, or policy—it’s about mindset. In 2025, retirement is less frequently defined by an age...

The face of retail banking is shifting, but not through headline-grabbing crypto products or high-risk lending experiments. Instead, it’s happening at the infrastructure level, where...

For all the talk about democratizing finance, real financial literacy still lags behind. Americans today have more tools than ever before—apps to invest spare change,...

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.